goyard london vat refund | how much is vat refund uk goyard london vat refund How does the VAT tax refund work? I know it's 12%. I've done it before in France and Italy.both times the stores issued me a form in store that I presented at the airport. 27,574 reviews. Staff. 7.4. +23 photos. This Las Vegas Strip hotel is 5 minutes' drive from the Las Vegas Convention Center. It features Adventuredome, an indoor theme park with a large roller coaster, plus circus-themed acts.Physical address. Circus Circus Hotel and Casino 2880 S. Las Vegas Blvd Las Vegas, NV 89109. P.O. Box. Circus Circus P.O. Box 14967 Las Vegas, NV 89114

0 · where to get a vat refund

1 · vat refund for travelers uk

2 · uk vat refund policy

3 · uk return on vat

4 · stores with no vat refund

5 · london heathrow vat refund

6 · how much is vat refund uk

7 · high end stores with vat refund

LOUIS VUITTON Official International site - Petite Malle V Monogram Canvas is exclusively on louisvuitton.com and in Louis Vuitton Stores. Discover more of our } Collection by Louis Vuitton

It goes more into depth about your savings, VAT refunds, how long you will wait, and what is the best location. Where and When Did I Get The Prices? I got the USA prices .

The refund process is completed on your final departure when you’re headed home. Your forms should have instructions on what steps to . The UK just reversed its elimination of VAT refunds for overseas shoppers. British Chancellor of the Exchequer Kwasi Kwarteng announced that as part of the government’s .

How does the VAT tax refund work? I know it's 12%. I've done it before in France and Italy.both times the stores issued me a form in store that I presented at the airport.

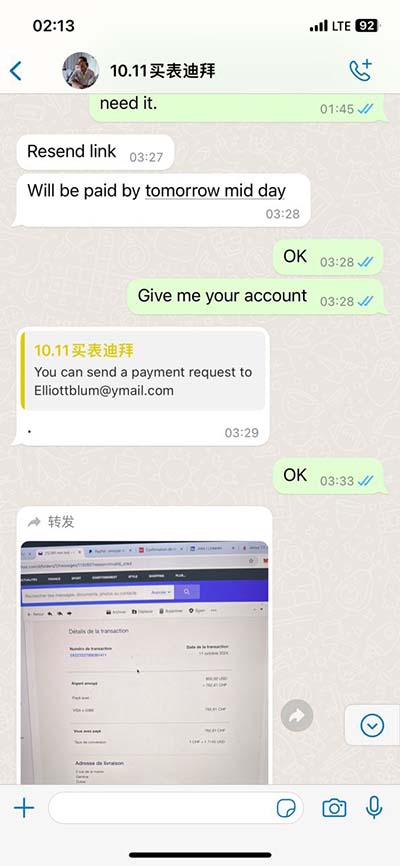

They state that it takes up to 30 days and many people say that they’ve received their VAT refunds as soon as a week after processing, but I purchased from Goyard in Paris at the end . Thus, since you would necessarily be "in-country," then would not receive VAT refund at all. However, since Goyard does not have local phone ordering methods, they might . The VAT refund in Paris is usually around 12% so you will actually be saving even more than what I’ve posted. Depending on the state you live in, you will be saving on taxes as . If seeking a VAT refund, you will not receive the full 20% back as there is, understandably, a processing fee. Goyard will fill out the paperwork and have you sign the .

Up until 1 January 2021, if you lived outside the EU and travelled to the UK for leisure or business, you were eligible for a VAT refund. The VAT-refund scheme was called the Retail Export . The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play.

It goes more into depth about your savings, VAT refunds, how long you will wait, and what is the best location. Where and When Did I Get The Prices? I got the USA prices from my local Beverly Hill store on July 23, 2024, and I got the Paris prices at the main Goyard store during my most recent back on June 14, 2024.

where to get a vat refund

vat refund for travelers uk

louis vuitton scacchi

The refund process is completed on your final departure when you’re headed home. Your forms should have instructions on what steps to take (and where to go), but here’s what to do. Find a VAT counter. The UK just reversed its elimination of VAT refunds for overseas shoppers. British Chancellor of the Exchequer Kwasi Kwarteng announced that as part of the government’s fiscal package, VAT refunds would be reintroduced as soon as possible for overseas tourists. How does the VAT tax refund work? I know it's 12%. I've done it before in France and Italy.both times the stores issued me a form in store that I presented at the airport.

They state that it takes up to 30 days and many people say that they’ve received their VAT refunds as soon as a week after processing, but I purchased from Goyard in Paris at the end of August this year and didn’t receive my refund until this past Friday, November 4th. Thus, since you would necessarily be "in-country," then would not receive VAT refund at all. However, since Goyard does not have local phone ordering methods, they might give you the reduced VAT back if shipped outside of the originating country (e.g., France). The VAT refund in Paris is usually around 12% so you will actually be saving even more than what I’ve posted. Depending on the state you live in, you will be saving on taxes as well since you don’t have to pay those if you buy your Goyard in Paris.

If seeking a VAT refund, you will not receive the full 20% back as there is, understandably, a processing fee. Goyard will fill out the paperwork and have you sign the document in the correct spots right there in the store.Up until 1 January 2021, if you lived outside the EU and travelled to the UK for leisure or business, you were eligible for a VAT refund. The VAT-refund scheme was called the Retail Export Scheme or tax-free shopping, but the UK government have now ended this scheme.

The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can be a bit tricky any time customs laws come in to play.

It goes more into depth about your savings, VAT refunds, how long you will wait, and what is the best location. Where and When Did I Get The Prices? I got the USA prices from my local Beverly Hill store on July 23, 2024, and I got the Paris prices at the main Goyard store during my most recent back on June 14, 2024. The refund process is completed on your final departure when you’re headed home. Your forms should have instructions on what steps to take (and where to go), but here’s what to do. Find a VAT counter. The UK just reversed its elimination of VAT refunds for overseas shoppers. British Chancellor of the Exchequer Kwasi Kwarteng announced that as part of the government’s fiscal package, VAT refunds would be reintroduced as soon as possible for overseas tourists.

How does the VAT tax refund work? I know it's 12%. I've done it before in France and Italy.both times the stores issued me a form in store that I presented at the airport. They state that it takes up to 30 days and many people say that they’ve received their VAT refunds as soon as a week after processing, but I purchased from Goyard in Paris at the end of August this year and didn’t receive my refund until this past Friday, November 4th. Thus, since you would necessarily be "in-country," then would not receive VAT refund at all. However, since Goyard does not have local phone ordering methods, they might give you the reduced VAT back if shipped outside of the originating country (e.g., France). The VAT refund in Paris is usually around 12% so you will actually be saving even more than what I’ve posted. Depending on the state you live in, you will be saving on taxes as well since you don’t have to pay those if you buy your Goyard in Paris.

If seeking a VAT refund, you will not receive the full 20% back as there is, understandably, a processing fee. Goyard will fill out the paperwork and have you sign the document in the correct spots right there in the store.

louis vuitton san marco 1345 venezia

uk vat refund policy

We exist to help people discover Jesus and The Journey. Service Times. Windmill + Online (PST) Sun: 9am | 11am | 6pm Midtown + Highlands Sun: 9:30am | 11am

goyard london vat refund|how much is vat refund uk